How to Use Factual Dispute Methodology

There is presently a high demand for credit repair considering the importance of credit to a person’s financial status. A Federal Trade Commission study of the U.S. credit reporting industry found that 1 in 4 consumers identified errors on their credit reports that might affect their credit scores.

In fact, the Consumer Financial Protection Bureau’s website in 2016, stated complaints about credit reporting were the highest percentage of all the complaints they received — more than 43,000, or about 23% of the total 186,000 complaints.

The time for ignoring credit report errors is over. Credit history and scores have permeated all aspects of our financial well-being.

Credit history and scores are not only used to determine if you’d be a good risk for credit cards, auto and mortgage loans but other types of businesses like utility companies, insurance companies and cell phone providers are using credit scores to decide whether to issue you a policy or provide you with a services.

Consumers with bad credit may even find it difficult to rent an apartment. Even if you’re extended credit, a low score may result in less favorable terms and higher interest rates.

This is why credit repair professionals go the extra mile to deeply research their client’s records to provide a solution. They even go through their clients’ credit reports together with their clients looking for information that is false, unverifiable, or incomplete, and then contacts the bureaus to have it modified or removed. This strategy is called the Factual Dispute Methodology.

This article will focus on what it is, and what it can do for you.

- What is The Factual Dispute Methodology?

- How Can You Dispute a Credit Report?

- Where do I Send my TransUnion Dispute Letter?

- Do Credit Dispute Letters Work?

- What Happens After You Send Dispute Letters to Credit Bureaus?

What is The Factual Dispute Methodology?

The Factual Dispute Methodology is an important distinction for credit repair companies who seek to help people restore their standing by referencing the Fair Credit Reporting Act (FCRA) to dispute inaccurate information. Nearly 80 percent of all credit reports in the US have inaccuracies that need to be modified. That is a staggering number. The basis of the Factual Dispute Methodology is the process of examining a client’s credit report to find these inaccuracies and creating a plan of action to dispute them.

Read Also: What to Dispute on a Credit Report

There are several types of negative items you will find on a consumer’s credit report, including inquiries, late payments, collections, bankruptcies, foreclosures, repossessions, judgments, and charge-offs. When examining a credit report, the first step is to determine whether each piece of information adheres to the following standards:

1. Is it Accurate?

Check that all account numbers, dates, account status, account types, and other information is correct based on the consumer’s personal records. Check that the credit reports you have accessed from all three bureaus contain the same exact information.

2. Is it Complete?

There should be no missing dates, account numbers, balances, or other information. This is one of the most common errors you will find on a credit report.

3. Is it Verifiable?

Creditors are required by law to have backup documentation for everything that is listed on a credit report. If the information does not exist, then the item should be removed completely. Are the records murky? Is there no signature from the client?

Once you have marked up the credit report with the items that are inaccurate, incomplete, or unverifiable, prioritize those that you will dispute first.

How Can You Dispute a Credit Report?

There’s no denying disputing negative credit can improve your credit history and raise scores. No matter how distasteful, you’ve got to find out why your credit score is low and come up with a plan for improving it. Credit repair often involves several strategies and learning how to dispute negative credit is a significant strategy.

1. Request your credit reports

You must dispute negative credit at each of the 3 major credit bureaus – Experian, Transunion and Equifax. This is important because each of your credit reports has the possibility of containing varying information. Fixing negative credit at one credit bureau does not fix your credit history at all the credit bureaus.

Review your credit reports and mark the items to be disputed. All negative information may or may not appear on every credit report so make sure you dispute with the appropriate credit bureau. You can order your credit reports for free every 12 months at annualcreditreport.com. You can get a free credit report once a year from each of the three major credit bureaus — Equifax, Experian and TransUnion — at AnnualCreditReport.com. That’s the only site where you can get the reports for free under the law. Many other sites offering “free” reports have strings attached.

Even if you’ve already obtained your report for the year, you’re entitled to another free report under the law if you believe your file is inaccurate because of fraud or if you’ve been denied credit, insurance or employment within the past two months. You can also purchase each of your credit reports for a small fee directly from the credit bureau.

2. Look for errors and mistakes

The best way to dispute an account is to find an actual error. I know many consumers dispute “account not mine” with some success but that’s not the best way to go. If the account really belongs to you being untruthful can come back to bite you. Factually based disputes are a lot harder for credit bureaus to verify and there may be several facts to dispute. However, make sure you dispute one factual reason at a time as you may not get the desired result the first time. Save some factually based disputes for future disputes, if needed.

Here are several factual errors that you can look for on your credit reports:

- Outdated information

- Incorrect account numbers

- Accounts that have been re-aged

- Incorrect balance

- Incorrect opening date

- Incorrect credit limit

- Credit card account not reporting credit limit

- Incorrect account type

- Charge off that has been sold or transferred has past due balance instead of zero balance

- Charge-off account showing currently past due

- Open charge-off accounts

- Accounts not included in bankruptcy

- Collection accounts with a credit limit

- Closed accounts reported as open

- You are reported as the owner of the account, when you are actually just an authorized user

- Accounts that are incorrectly reported as late or delinquent

- Incorrect date of last payment, date opened, or date of first delinquency

- Same debt listed more than once (possibly with different names)

- Name misspellings

- Wrong date of birth

- Incorrect addresses

- File merging or identity mix-up (your name may be similar or the same of someone else)

- Reinsertion of incorrect information after it was corrected

- Accounts that appear multiple times with different creditors listed (especially in the case of delinquent accounts or accounts in collections)

- Reinsertion of incorrect information after it was corrected

- Incorrect accounts resulting from identity theft

Carefully review your credit report to find factual errors. Your goal is to get negative information deleted, not corrected. Always request deletion of negative information. There is no guarantee that you will get a deletion, it may just be corrected, but it does not hurt to ask for a deletion.

3. Gather documents to support your dispute

Disputes that have supporting documentation are in a better position of being deleted or corrected. That may mean locating a document that shows you closed an account on a specific date or finding a canceled check that shows you made a payment listed as delinquent.

4. Avoid Online Disputes if possible

Initiating credit disputes online is convenient but disputing credit mistakes online may lead you to dispute every negative item at once. Do not make this mistake! Disputing every negative item, especially if you have many of them, may lead to your dispute being marked as frivolous. Frivolous credit disputes can prevent an item from being investigated. The credit reporting agencies can reject further disputes for up to 12 months.

Additionally, online disputes limit the facts on which you can challenge a negative credit item and may prohibit you from sending any documentation in support of the dispute. Unless you are doing a simple dispute like a negative item is obsolete and too old to be on your credit report, written disputes are generally better.

5. Write Your Dispute Letter

Writing a straightforward, precise dispute letter is imperative. You want your letter read, acted upon, and not discarded as frivolous. Keep good records as you may need them later. The credit reporting agencies have 30 days after receipt of the dispute to conduct an investigation and resolve the matter. If you have documentation to support your dispute include that with your dispute letter. Send one dispute letter at a time and only include a few negative items per dispute letter. Wait for your results and follow up with another dispute if necessary but wait at least 60 days.

6. Create An Emergency

The credit bureaus receive a vast amount of disputes daily so make sure you create an emergency in order for the dispute to be taken seriously. Let them know you are in the process of obtaining a mortgage or auto loan and the errors in your report are hurting your chances of being approved or causing the lender to only offer subprime interest rates. You may even be job hunting and need a clean credit report to get hired. Those are just examples but you get the drift.

7. Collection Agency Debt

Starting the dispute process may alert debt collectors you are attempting to repair your credit. Be aware that once you begin the dispute process you may have to deal with debt that is still within the state of limitations which means you could be sued by a debt collector.

8. Where to start the dispute process

Begin the dispute process with the credit reporting agencies first. You may get the negative item deleted and no further action has to be taken. If you start disputing directly with a creditor first, you could end up engaging in a long battle to get an item deleted.

9. Make deletion your goal

Request full deletions when disputing credit, especially for credit score-killing items such as collection accounts. Correcting a date or amount on a negative credit item still remains negative. But deleting a negative credit item might result in a change in credit score. For example, a paid or unpaid collection account holds the same weight as they are both viewed as negative tradelines.

10. Know when NOT to Dispute

Be careful about disputing old debts. You could bring the debt back to life by disputing it and awaken the creditor’s or collection agency’s interest in collecting the debt. If the debt is within the Statute of Limitations you could get sued. If the statute of limitations has expired, you are safe from a lawsuit.

Be careful not to do anything that may re-start the statute of limitations by acknowledging, making a payment or even agreeing to pay on the debt. As a negative item gets older, the percentage it’s calculated into your credit score dramatically decreases. Keep in mind your credit score is calculated primarily using the two most recent years of your credit history.

Where do I Send my TransUnion Dispute Letter?

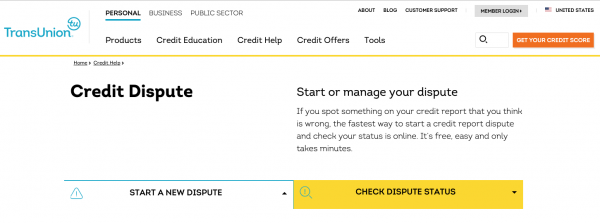

The vast majority of consumers, 75%, go online to file a dispute. The TransUnion online dispute portal looks like this:

If you do not already have a TransUnion account, you’ll need to create one and set a password. Once you’re signed in, you can choose “new investigation” and you’ll see your credit report.

Review the personal information and click to edit as needed, then review the accounts and click on the blue “request investigation” to initiate a dispute. Fill out the fields and provide additional information as needed.

Once you’ve marked everything you want updated or investigated, click the “Continue” button. You’ll have an opportunity to upload any supporting documents. Finish filing your dispute by clicking “Submit.”

TransUnion will respond by email; you can also sign back into your account to check the progress of the dispute.

How to dispute your TransUnion report by mail

You can send disputes by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000.

TransUnion recommends including the following in your dispute letter:

- Your Social Security number and date of birth.

- Your current address.

- The company name and account number are associated with the disputed item.

- The reason for your dispute: It’s not your account, you’ve paid the account, etc.

- Corrections to personal information.

In your letter, explain which item(s) you think are incorrect and why. Send copies — not originals — of supporting documents. The bureau will respond by mail.

How to dispute your TransUnion credit report by phone

You can dispute by phone at 800-916-8800. Have a copy of your TransUnion credit report handy before calling this number; the representative will need the file number. The representative will tell you how to send supporting documents, if necessary. The bureau may respond by email or mail.

Do Credit Dispute Letters Work?

Credit bureaus are very efficient at handling the disputes they receive. The process is often highly automated and, in fact, many disputes are investigated and resolved one way or the other within a couple of weeks.

Is it possible that some disputes will fall through the cracks or that the company furnishing the information to the credit bureaus won’t respond? Of course, it is.

But because the large majority of information on credit reports comes from major financial institutions, it’s more likely that the credit bureau will get a response from the furnisher and, if the information is correct, it will continue to be reported. So if you are looking for a sure-fire strategy to remove accurate but negative information from your credit reports, you should know it’s something of a gamble.

If you find negative information that is inaccurate or incomplete on your credit reports — or information that doesn’t belong to you — you can and should dispute it. If you decide to do that by sending a letter, here are a few tips:

- Be sure to include your full contact information, including your address and your Social Security number. You need to include a copy of a government-issued ID and a copy of a bill with your current address on it — phone bills or utility bills work best. The credit reporting agency needs to be able to correctly identify information in your credit report.

- Keep your dispute short, specific, and to the point if at all possible. Someone is going to have to enter your dispute into the credit bureau’s computerized system. Don’t make them guess what you’re trying to dispute.

- Include any information or evidence to support your dispute, if available. For example, you could include a copy of a canceled check that shows you paid on time.

- You don’t have to quote federal laws because the credit reporting agencies know their responsibilities when it comes to investigating disputes. But it is essential that you clearly explain clearly and concisely what you are disputing and why. For example, don’t just say information is wrong; state why you believe it’s wrong.

Keep in mind, the FCRA applies to consumer credit reports but not to business credit reports. You can (and should) dispute incorrect or incomplete items on your business credit reports, but there’s no requirement that the item be removed if the credit bureau doesn’t respond within 30 days.

What Happens After You Send Dispute Letters to Credit Bureaus?

Your credit report is a compilation of information about how you keep up with your credit obligations. Many of the businesses that you have a financial relationship with send your account information to the three major credit bureaus—Equifax, Experian, and TransUnion—who then put the information together in your credit report. Whenever you make an application for credit, your credit report is reviewed to make a decision about you.

You can also review your credit report to make sure the information included is correct. Under the Fair Credit Reporting Act, you can have errors removed by submitting a written credit report dispute to the credit bureau(s) listing the inaccurate information.

Once you submit your credit report dispute, the credit bureau(s) and the business providing the information have some steps to follow.

Credit Bureau Investigation

The credit bureau must review all of the information and documents received from you and then investigate your dispute within 30 days of receiving it. The credit bureau has to notify the business who provided the information—the “furnisher”—of the dispute within five business days of receiving it. The credit bureau also must give your dispute information to the furnisher.

Creditor Investigation

The information furnisher must review the information provided by the credit bureau and investigate the dispute. When the furnisher has reached a conclusion, it’s required to report the results to the credit bureau. If the investigation results in a change to your credit report, the furnisher is required to let all three credit bureaus know.

Credit Report Update

If the credit bureau finds that the information you disputed is inaccurate or unverifiable, it’s required to correct the information or remove it from your credit report. The credit bureau must also notify the furnisher that it’s been removed.

With your permission, the credit bureau can send your updated credit report to any business that has requested your credit report within the last six months.

If the credit bureau does not correct the information that you know to be inaccurate, you also have the right to dispute it directly with the business that listed the information on your credit report. That way, you can bypass the credit bureau—which sometimes uses an automated process to “verify” information on your credit report—and have the information furnisher take a closer look at its records.

Read Also: How to Give a Credit Audit

Sometimes, the source of your credit report error originates in a computer system that needs to be corrected by a human. Initiating a dispute directly with the creditor or lender can help you with this process.

If you’re not satisfied with the results of the investigation, you have the right to submit a 100-word statement to be added to your credit report. If you believe that the credit bureau has violated the law while processing your dispute, you can send a complaint to the Consumer Financial Protection Bureau.

You may also have the right to sue a credit bureau that does not correct credit report errors. Talk to a consumer rights attorney about your case to see whether you have grounds to file a lawsuit under the Fair Credit Reporting Act.