How a Credit Score is Calculated

If you are looking to get credit, your credit score is one of the things you need to pay close attention to. It will determine whether you are credit-worthy or not. Your FICO® Score is a three-digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. The higher your score is, the less risky you are to lenders.

Credit scores provided by the three major credit bureaus — Equifax, Experian, and TransUnion — may also vary because not all lenders and creditors report information to all three major credit bureaus. While many do, others may report to two, one, or none at all. In addition, the credit scoring models among the three major credit bureaus are different, as well as those used by other companies that provide credit scores, such as FICO or VantageScore.

If you are fully aware of the things that impact your credit score, it will help you know how to work on your score and improve it eventually. Let’s see the factors that impact your credit score, how it’s calculated, and how you can improve it.

- How is my Credit Score Calculated?

- How Are All Three Credit Scores Calculated?

- Which of The 3 Credit Scores is Usually The Highest?

- How Can I Build a Higher Credit Score?

- Are All 3 Credit Scores Similar?

- What Makes up 30 of Your Credit Score?

How is my Credit Score Calculated?

The types of credit scores used by lenders and creditors may vary based on their industry. For example, if you’re buying a car, an auto lender might use a credit score that places more emphasis on your payment history when it comes to auto loans. In addition, lenders may also use a blended credit score from the three major credit bureaus.

Read Also: How to Build Good Credit

In general, here are the factors considered in credit scoring calculations. Depending on the scoring model used, the weight each factor carries as far as impacting a credit score may vary.

- The number of accounts you have

- The types of accounts

- Your used credit vs. your available credit

- The length of your credit history

- Your payment history

Here is a general breakdown of the factors credit scoring models consider, keeping in mind there are many different credit scoring models.

Payment history

When a lender or creditor looks at your credit report, a key question they are trying to answer is, “If I extend this person credit, will they pay it back on time?” One of the things they will take into consideration is your payment history – how you’ve repaid your credit in the past. Your payment history may include credit cards, retail department store accounts, installment loans, auto loans, student loans, finance company accounts, home equity loans, and mortgage loans.

Payment history will also show a lender or creditor details on late or missed payments, bankruptcies, and collection information. Credit scoring models generally look at how late your payments were, how much was owed, and how recently and how often you missed a payment. Your credit history will also detail how many of your credit accounts have been delinquent in relation to all of your accounts on file. So, if you have 10 credit accounts, and you’ve had a late payment on 5 of those accounts, that ratio may impact credit scores.

Your payment history also includes details on bankruptcies, foreclosures, wage attachments, and any accounts that have been reported to collection agencies.

Generally speaking, credit scoring models will consider all of this information, which is why the payment history section may have a big impact in determining some credit scores.

Used credit vs. available credit

Another factor lenders and creditors are looking at is how much of your available credit – the “credit limit” – you are using. Lenders and creditors like to see that you are responsibly able to use credit and pay it off, regularly. If you have a mix of credit accounts that are “maxed out” or at their limit, that may impact credit scores.

Type of credit used

Credit score calculations may also consider the different types of credit accounts you have, including revolving debt (such as credit cards) and installment loans (such as mortgages, home equity loans, auto loans, student loans, and personal loans).

Another factor is how many of each type of account you have. Lenders and creditors like to see that you’re able to manage multiple accounts of different types and credit scoring models may reflect this.

New credit

Credit score calculations may also consider how many new credit accounts you have opened recently. New accounts may impact the length of your credit history.

Length of credit history

This section of your credit history details how long different credit accounts have been active. Credit score calculations may consider both how long your oldest and most recent accounts have been open. Generally speaking, creditors like to see that you have a history of responsibly paying off your credit accounts.

Hard inquiries

“Hard inquiries” occur when lenders and creditors check your credit in response to a credit application. A large number of hard inquiries can impact your credit score. However, if you are shopping for a new auto or mortgage loan or a new utility provider, the multiple inquiries are generally counted as one inquiry for a given period of time. That period of time may vary depending on the credit scoring model, but it’s typically from 14 to 45 days.

Credit score calculations do not consider requests a creditor has made for your credit report for a preapproved credit offer, or periodic reviews of your credit report by lenders and creditors you have an existing account with. Checking your own credit also doesn’t affect credit scores. These are known as “soft inquiries.”

How Are All Three Credit Scores Calculated?

Most people have three scores from the credit agencies; Experian, Equifax, and Transunion. For people with limited credit, they would have one or two or even no scores.

Most lenders will usually take the middle of the three scores. If there are two borrowers, then the lenders use the lowest of the two middle scores.

For example, there are two borrowers and their scores are as follows:

Borrower 1: 750, 701, 685

Borrower 2: 678, 643, 601

The middle score for borrower 1 would be 701 and the middle score for borrower 2 would be 643.

The lowest of the middle scores would be 643.

However, some lenders will take the average of the scores instead of the middle or the lowest of the middle scores. To take the average, you take to add all the scores and then divide by the number of scores.

In the example above, the average score for borrower 1 would be 712 ((750+701+685)/3). For borrower 2, the average score is 640 ((678+643+601)/3).

The average of both scores is 676 ((712+640)/2). Another way is to sum up all the scores and then divide by 6.

The credit score of 643 versus 676 isn’t that great but to the lender, it makes a huge difference. It can be a matter of getting an excellent rate or a mediocre one.

Which of The 3 Credit Scores is Usually The Highest?

VantageScore and FICO are the two main credit-scoring models. For both the VantageScore and base FICO® score models, the lowest score is 300 and the highest credit score is 850.

But even if you have pretty good credit habits, don’t be surprised if you check your scores and find that you’re below 850.

Perfect credit scores can seem to be inexplicably out of reach. Out of 200 million consumers with credit scores, the average FICO score is 704. And FICO says that as of April 2019, just 1.6% of Americans with credit scores had perfect FICO scores.

While VantageScore and FICO scoring models have differences, both make it clear that some factors are more influential than others.

For both models, payment history is the most important factor, followed by the total amount of credit you owe (also described as the percent of credit limit used and total balances/debt).

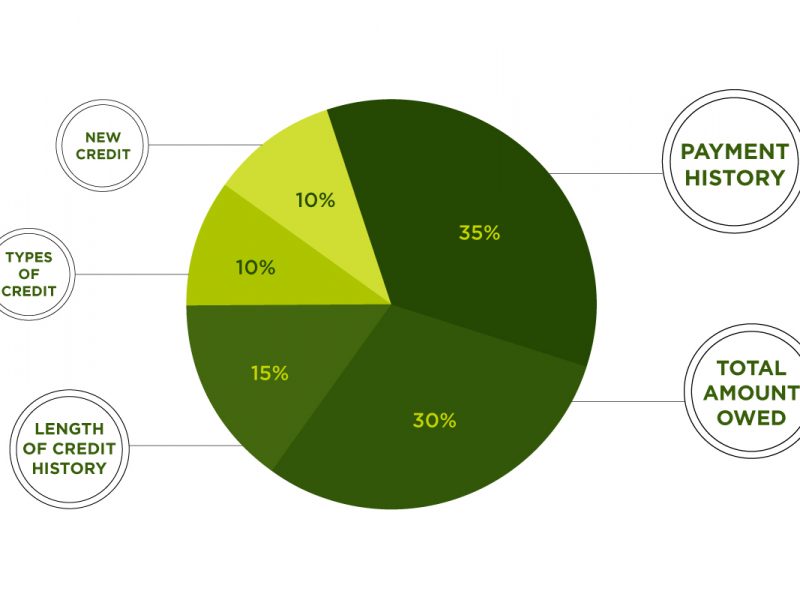

FICO uses percentages to indicate the importance of each factor to your credit scores.

| FICO | |

|---|---|

| Factor | Importance |

| Payment history | 35% |

| Amounts owed | 30% |

| Length of credit history | 15% |

| New credit | 10% |

| Credit mix | 10% |

VantageScore doesn’t assign specific percentages to factors, but it does state that some factors are more influential than others. Here’s how your VantageScore breaks down.

| VantageScore | |

|---|---|

| Factor | Importance |

| Payment history | Extremely influential |

| Age and type of credit | Highly influential |

| Percent of credit limit used | Highly influential |

| Total balances/debt | Moderately influential |

| Recent credit behavior and inquiries | Less influential |

| Available credit | Less influential |

How Can I Build a Higher Credit Score?

Based on the factors we have discussed above, here are a few strategies to help you build higher scores.

Pay your bills on time

The frequency of your on-time payments is the factor that influences your scores the most.

Setting up automatic payments on your credit card bills can be a helpful way to avoid forgetting a payment, but make sure you have enough money in your accounts to cover automatic payments. Otherwise, you may have to pay fees.

Make sure there are no negative marks on your credit report

Even if you’ve never missed a payment, there could be illegitimate negative marks on your credit reports. Be sure to check your Transunion and Equifax credit reports for free from Credit Karma and make sure there are no errors.

If you find incorrect marks on your reports, you can dispute them. Upon receiving a dispute, the credit-reporting companies are required to investigate and fix errors in a timely manner.

Even if you have legitimate negative marks on your credit reports, they will affect your scores less over time and should eventually fall off your reports completely.

Keep your credit utilization rate low

Both scoring models weigh this factor heavily. To determine your current utilization rate, begin by adding up the credit limits of all your credit cards.

Let’s say you have two credit cards — one with a limit of $2,000 and another with a limit of $3,000. This gives you $5,000 of total available credit.

Next, divide your current total balances (what you owe) by your available credit and multiply it by 100 to get the percentage. Imagine you have $1,000 in outstanding balances — $1,000 divided by $5,000 is 0.20 — so, in this example, your utilization rate would be 20%.

As you spend less of your available credit, your credit utilization rate goes down. In the above example, if you reduced your credit card spending to $500, your utilization rate would drop to 10%.

What credit utilization rate should you aim for? Using no more than 30% of your available credit is a great start.

Limit your hard credit inquiries

When you apply for credit of any kind, it generates a hard credit inquiry. Since applying for new credit can be an early sign that someone is dealing with financial troubles, hard inquiries will have a slightly negative effect on your scores temporarily.

If you want to get a really high score, you’ll want to limit your hard inquiries — meaning you should only apply for new credit when necessary.

Don’t cancel cards needlessly

As you can see, both models look favorably on consumers who have longer credit histories and lower credit utilization ratios.

Unfortunately, you can’t magically create 10 years of credit history. What you can do is choose one or two credit cards to keep active and never cancel. Not only will this help you build a long credit history, but it can also help you keep your credit utilization rate low since more active credit cards in your name mean more available credit.

Are All 3 Credit Scores Similar?

In the U.S. there are several different credit bureaus, but only three are of major national significance: Equifax, Experian, and TransUnion. This trio dominates the market for collecting, analyzing, and disbursing information about consumers in the credit markets.

In the U.S. there are several different consumer reporting agencies, but only three are of major national significance: Equifax, Experian, and TransUnion. This trio dominates the market for collecting, analyzing, and disbursing information about consumers in the credit markets.

Credit scores have historically been based on the FICO score associated with the data-analytic company originally known as the Fair Isaac Corporation. While you can still get a FICO score from any of the big three, their calculation methods differ, and Experian uses its own FICO score, also known as “Experian/Fair Isaac Risk Model v2.”

Equifax

Based in Atlanta, Equifax has approximately 11,000 employees and “operates or has investments in 24 countries”: Argentina, Australia, Brazil, Cambodia, Canada, Chile, Costa Rica, Ecuador, El Salvador, Honduras, India, Malaysia, Mexico, New Zealand, Paraguay, Peru, Portugal, Russia, Saudi Arabia, Singapore, Spain, the U.K., the U.S., and Uruguay. Especially dominant in the U.S. South and Midwest, it claims to be the market leader in most of the countries in which it has a presence.

Experian

With domestic headquarters in Costa Mesa, Calif., Experian originally handled reports for the Western United States. Now it promotes itself as “the leading global information services company.” The firm employs “approximately 17,000 people in 37 countries” and has its corporate headquarters in Dublin, Ireland, with operational headquarters in Nottingham, U.K., and São Paulo, Brazil.

TransUnion

Marketing itself as “a global information and insights company that makes trust possible,” the Chicago-based TransUnion has regional offices in Hong Kong, India, Canada, South Africa, Colombia, the U.K., and Brazil and employs more than 8,000 people.

All three credit bureaus collect the same type of information about consumers. This includes personal data, such as name, address, Social Security number, and date of birth. It also includes credit history, including debts, payment history, and credit application activity. It is common practice for the credit bureaus to collect information from federal and private student loans and housing lenders.

If you are delinquent in making student loan payments, Sallie Mae can report you to a credit bureau—typically after the 45-day mark. Federal loans provide more leeway, allowing 90 days to pass before filing a report.

The Internal Revenue Service (IRS) doesn’t report overdue income tax to the bureaus. However, if a taxpayer does not repay their tax debt in a reasonable amount of time, or if they owe a lot of back taxes, the IRS might file a federal tax lien (a legal claim against a taxpayer’s property) with the local county clerk’s office. A tax lien filing is considered public information, and the bureaus can find it through third-party research.

Two of the biggest companies when it comes to credit scoring models are Fair Isaac Corporation (FICO) and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus: Equifax, Experian, and TransUnion. Each of the credit unions has built its own FICO models specific to different types of lending.

While FICO 8 is commonly used across all bureaus to assess general creditworthiness, each bureau has a different model for different types of lending. For example, Experian developed FICO 2, Equifax uses their FICO 5, and TransUnion has its own version in FICO 4.

What Makes up 30 of Your Credit Score?

By design, your credit score comes from the information found on your credit report. If an item doesn’t show up on a credit report, it can’t affect your score.

For example, your bank account balance doesn’t appear on your credit report. Neither does your income or your net worth. None of these factors play a role when a scoring model calculates your credit score.

Factors that do impact your FICO Score fall into one of the following five categories.

- Payment History: 35%

- Amounts Owed: 30%

- Length of Credit History: 15%

- New Credit: 10%

- Credit Mix: 10%

In each category, a scoring model will ask questions about your credit report. For example, “Does the report show any late payments?” These questions are known as characteristics in the credit scoring world. The answers to these questions, called variables, determine the number of points you earn. When the scoring software adds all of those points together, you get your credit score.

Payment History (35%)

Your bill-paying track record has the most weight when it comes to your credit score. On-time payment history won’t earn you a perfect 850 FICO Score, but it’s a great place to start.

In the payment history category, a scoring model may ask questions such as:

- Are there any late payments on the credit report?

If the answer is yes, follow up questions may include:

- How late were the payments (e.g., 30 days, 60 days, 90 days, etc.)?

- How long ago did the late payments take place?

- How many late payments appear on the report?

A single 30-day late payment might not destroy your credit score if the rest of your report is in good shape, though you should expect some damage. But if you have multiple late payments or more severe late payments (e.g., 60 days late or worse), your scores might take a harder hit.

Other payment-related information could harm your score in this category as well. Bankruptcies, collection accounts, charge-offs, repossessions and foreclosures won’t do you any favors.

Thankfully, credit scores do take time into account. If you avoid negative payment history in the future, the impact of old credit mistakes will shrink, little by little.

Amounts Owed (30%)

A recent credit score survey by the Consumer Federation of America and VantageScore Solutions revealed a troubling statistic. A little over one-third of survey participants didn’t know that maintaining a low credit card balance was good for their credit score.

If you have credit cards, keeping a low balance-to-limit ratio (a.k.a. credit utilization ratio) might help you earn and keep a better credit score. Credit utilization is largely responsible for 30% of your FICO Score.

Aside from credit utilization, a scoring model may consider the following questions when it evaluates the Amounts Owed category of your credit report:

- What’s the total amount of debt on the credit report?

- How does the debt break down among different types of accounts (e.g., credit cards, mortgages, auto loans, student loans, etc.)?

- What’s the total number of accounts with balances?

Paying down your credit card balances is always wise—potentially good for both your credit score and your bank account. Yet as long as you’re on time with your large installment loans like mortgages, auto loans and student loans, the balances on these accounts probably won’t have much impact on your credit score.

Length of Credit History (15%)

The third most influential category of information when it comes to your credit score is the length of your credit history. FICO won’t consider your age when it calculates your credit score, but the age of your accounts is fair game.

FICO scoring models will ask the following questions when it considers your age of credit:

- What are the ages of the newest and oldest accounts on the credit report?

- What’s the average age of all the accounts combined?

- How long has each individual account been open?

- When was each account last active?

Time is your friend in this credit report category. Older accounts and older average age of accounts may help you to earn more points for your overall credit score.

Many people simply have to wait for time to do its magic when it comes to their length of credit history. However, if you have a loved one with an older, well-managed credit card account, you might be able to speed up the process.

If someone you know is willing to add you as an authorized user to an existing credit card, the account might show up on your credit reports. Assuming the account is older (with no late payments and low credit utilization), it could help lengthen your average age of credit and potentially give your credit score a boost.

New Credit (10%)

Have you heard that checking your credit report might hurt your credit score? That’s true, but only sometimes.

Ten percent of your FICO score comes from the New Credit category of your credit report. One of the factors considered in this category is how many recent inquiries (a.k.a. credit checks) show up on your report.

When you apply for new credit, and a lender checks a copy of your credit report, this is known as a hard inquiry. Hard inquiries appear on your credit report for 24 months. Some hard inquiries may hurt your credit score for up to 12 months, but others may be ignored.

Soft inquiries may show up on your credit too, but only on reports, you check yourself. A soft inquiry usually happens when you check your own credit or when a lender targets you for a pre-approved offer of credit. Soft inquiries never impact your credit score.

In addition to reviewing inquiries on your report, a scoring model may also ask:

- How many new accounts appear on the credit report?

- What’s the open date of those new accounts (if any are present)?

It’s best to make a habit of only applying for and opening new credit when you need it. Yet if you don’t go overboard, you shouldn’t be afraid to leverage your good credit rating to take advantage of an attractive offer.

Credit Mix (10%)

The final category that makes up your credit score has to do with the types of accounts that show up on your credit report. Diversity will help you here.

Having experience managing multiple a variety of accounts can be an asset, albeit a small one, to your credit score. A scoring model may ask whether the following types of accounts show up on your report:

- Credit Cards

- Installment Loans

- Retail Accounts

- Mortgage Loans

- Finance Company Accounts

A variety of different account types may be good for your credit score. If your credit report has no revolving accounts, opening a new credit card (and managing it well) could potentially benefit you in the long run. Likewise, a credit builder loan might also be helpful if you have zero installment accounts on your report, but this isn’t usually the best way to build your credit due to the cost.

A credit builder loan has the unique ability to help you build a small savings fund while establishing a positive tradeline on your credit reports, assuming the lender reports to the credit bureaus. You get access to the loan funds once you make your final payment.

Read Also: How Does a Self Credit Card Work?

Credit builder loans aren’t free. Be sure you’re comfortable with the cost (interest and fees) and that have room for it in your budget before you apply. If you already have other positive installment accounts on your credit report, this type of loan might not benefit you as much as you hope.

Finally, consider spreading out new credit applications rather than opening several accounts at once. You should also avoid taking on new debt for the sole purpose of improving your credit mix.

Bottomline

While having perfect credit scores may not be necessary to qualify for great rates on loans and mortgages, improving poor scores to good, or good scores to excellent, can make a big difference.

By following the right credit habits and building your credit following the guidelines outlined above, you can make improvements to your scores. And if you happen to reach 850 along the way, then consider it a cool bonus.