Why Credit Scores go Down After Clearing Your Debts

When you are about to pay off your debt, you are very excited because it is a huge win for you. However, sometimes you discover that your credit score does not really increase the way you expected it to. This can be frustrating and you begin to wonder why your credit score keeps going down instead of increasing.

While seeing the points drop in your credit score can feel like a loss, understanding why can help you make a plan to bump your score back up. Understand the factors that impact your credit score and how you can keep your score in good standing even after paying off debt.

We are going to give some insight as to why this is so.

- How Are Credit Scores Calculated

- Why Did my Credit Score Drop After Paying Off my Loan?

- Why Didn’t my Credit Score go up When I Paid Off a Collection?

- Why Did my Credit Score Drop When my Balance Decreased?

- Does Paying Off All Debt Increase Credit Score?

How Are Credit Scores Calculated

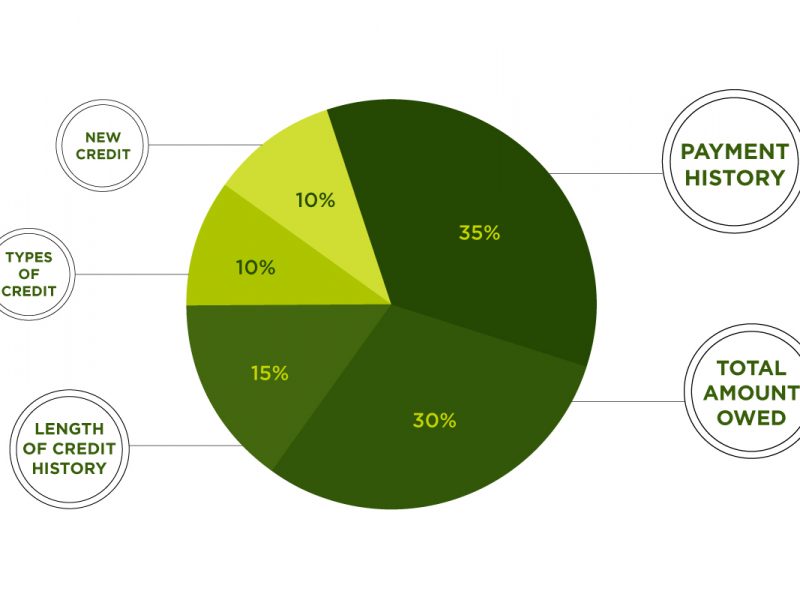

FICO scores are calculated using five key factors: payment history (35 percent), credit utilization/amounts owed (30 percent), length of credit history (15 percent), credit mix (10 percent), and new credit (10 percent).

Payment history

Your credit score is heavily influenced by how often you make timely payments on your accounts. Missing payments or defaulting on loans will tank your score quickly.

Read Also: How to Remove Mortgage After Divorce

Paying off your debt shouldn’t affect this aspect of your credit score. However, it’s still an important consideration. If you deliberately miss payments in order to keep an account open longer and avoid other negative effects of paying off debt, your credit score will suffer.

Credit utilization

One area directly affected after you pay off debt is your credit utilization. Your utilization is calculated by dividing the balances you carry by your total credit limit across all of your cards.

This category of your credit score includes your credit utilization ratio for each credit card as well as your overall balances. Ideally, your balances should be between 10 and 30 percent of your available credit. If you paid off an account that had a low balance but your other cards are close to being maxed out, you may still see poor credit utilization. You can also be impacted if you pay off all of your debt and have no credit utilization.

Length of credit history

The average age of your credit accounts is another important factor in determining your credit score. Having many older accounts has a positive impact on your credit score, and having several new accounts is a negative contributing factor. If you pay off debt on an older account and subsequently close it, your credit score may drop.

Credit mix

Installment loans (like car loans, student loans or home mortgages) have a set period in which they will be paid off. Credit card debt is considered “revolving” debt, which varies from month to month and does not have a set time period to repay. Installment loans don’t impact your score as heavily as revolving debts like credit cards and lines of credit, because there’s a set repayment period.

This category of your credit score is called your credit mix. Lenders like to see a mix of both installment loans and revolving credit on your credit portfolio. So if you pay off a car loan and don’t have any other installment loans, you might actually see that your credit score dropped because you now have only revolving debt.

New credit

When you pay off debt, your credit score may drop for totally unrelated reasons. One common reason is new inquiries on your report. Every time you apply for new credit where the creditor runs a hard credit check, it’s listed on your credit report. It stays there for two years and may result in a temporary drop in your score. If you applied for a loan or a new credit card around the same time you paid off your debt, you may have unintentionally caused a drop despite your lower overall debt.

Why Did my Credit Score Drop After Paying Off my Loan?

Your credit score is calculated using a specific formula. Your score is an indicator for how likely you are to pay back a loan on time. Several factors contribute to the credit score formula, and paying off debt does not positively affect all of them. Paying off debt may lower your credit score if it changes your credit mix, credit utilization or average account age. Here are some scenarios that could negatively affect your credit score:

- You eliminated your only installment loan or revolving debt: Creditors like to see that you’re able to manage various types of debt. If eliminating a particular debt makes your credit report less diverse, it can negatively affect your score. For example, if you pay off an auto loan and are left with only credit cards, your credit mix suffers.

- You’ve increased your overall credit utilization: Keeping the overall utilization of your available credit low (in other words, not maxing out all of your credit cards or lines of credit) results in a better score. But when you pay off a revolving line of credit or credit card in its entirety and close the account or let the account go inactive (which often leads to it being closed), it decreases the total amount of credit you have available, potentially increasing your remaining utilization rate.

- You’ve lowered the average age of your accounts: The longer your accounts have been open and in good standing, the better. Having a 20-year-old account on your report is a good sign, even if you don’t use it; closing that account and being left with accounts no more than five years old dramatically reduces the average age of your accounts.

Why Didn’t my Credit Score go up When I Paid Off a Collection?

A collection account is an entry on your credit report that indicates a default on a previous obligation. The original creditor either sold the defaulted debt to a debt buyer or consigned the debt to a collection agency. The goal of the collector, not surprisingly, is to work on behalf of its client to collect the defaulted debt from the debtor or as much of it as possible.

Collection accounts are considered by both FICO®‘s and VantageScore’s credit scoring systems and can be highly influential to your credit scores. Collections fall under payment history, which is the biggest factor in your FICO® Score☉ calculation, driving 35% of your score. Consumers with collections on their credit reports are likely to have lower credit scores than consumers who have no collections.

In addition to the potential impact to your credit scores, the presence of collections also can influence lender decisions. For example, Fannie Mae, which provides financing to mortgage lenders, has several policies requiring that collections be paid off prior to you closing on a mortgage loan.

It’s always a good idea to pay collection debts you legitimately owe. Paying or settling collections will end the harassing phone calls and collection letters, and it will prevent the debt collector from suing you. The debt collector will then update your credit reports to show the collection account now has a zero balance.

While it’s natural to assume that paying or settling a collection account will lead to a higher credit score, this is not always the case. As with most questions regarding credit scores, the answer to whether paying a collection will be helpful is: “It depends.”

Newer credit scoring models ignore collections that have a zero balance. This is true for both the most recent version of FICO®‘s credit score, FICO® 9, and the two newest versions of the VantageScore® credit score, 3.0 and 4.0.

When you pay or settle a collection and it is updated to reflect the zero balance on your credit reports, your FICO® 9 and VantageScore 3.0 and 4.0 scores may improve. However, because older scoring models do not ignore paid collections, scores generated by these older models will not improve.

This is important because some lenders, especially mortgage lenders, use older versions of the credit scoring models. This means despite it being a good idea to pay or settle your collections, a higher credit score may not be the result. If you do choose to pay or settle your collections, it is a good idea to see how it impacts your credit scores. You can check your FICO® Score from Experian for free.

Keep in mind that the FICO® Score currently available from Experian is the FICO® 8 version, which does not ignore paid collections. This is a good measuring stick because if you’ve got a solid FICO® 8 Score even after paying your collections, it’s likely that your FICO® 9 and VantageScore 3.0 and 4.0 credit scores will be equally strong, or even better.

Why Did my Credit Score Drop When my Balance Decreased?

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts (which may shorten your length of credit history overall), or applying for new credit accounts.

Below are the nine main reasons why your credit scores might have dropped, and how you can address each of them.

1. Late or missed payment

Payment history is a critical component of credit scores. In fact, FICO® says that it’s the most important factor in its scoring model, accounting for 35% of it.

If you were only a few days late on a payment, it’s unlikely to show up on your credit reports. But once payments are more than 30 days late, card issuers will report them as delinquent to the credit bureaus. If this happens to you, you can expect your credit scores to take a hit. And if the payment is reported as being 60 or 90 days late, your credit scores could fall even further.

Keeping track of payments can be difficult, especially if you have multiple credit cards and loans. If you’re worried about bills getting lost in the mail pile, enrolling in automatic payments could be a smart move.

2. Derogatory mark on your credit reports

Derogatory marks on your credit reports indicate that you didn’t pay a loan as agreed in some way. Here are a few reasons why your bank or credit issuer may have placed a derogatory item on your credit report.

- Late payment

- An account in collections (or charge-off)

- Bankruptcy

- Lawsuit

- Judgment

- Foreclosure

- Tax lien

Unlike hard credit inquiries, derogatory marks don’t fall off your credit reports in two years. Instead, they’ll typically remain on your reports for seven to 10 years.

That means your credit scores could be negatively affected by a derogatory mark for close to a decade. But the good news is that the effect of a derogatory mark goes down over time.

Additionally, you may be able to get certain derogatory remarks taken off your credit reports. If you see a derogatory remark on a report, first verify that it’s legitimate. If it’s not, contact the credit bureaus to dispute it. If you’re a Credit Karma member, you can use our free Direct DisputeTM feature to help dispute the error.

3. Change in credit utilization rate

Your credit utilization rate (how much of your available credit you use) is another important factor in determining credit scores. VantageScore says that it’s “extremely influential,” and FICO® says that it accounts for 30% of your overall score.

If you spent more than usual last month (because of a large purchase, family vacation, or other reasons), it will increase your credit utilization rate. How far will your scores drop because of it? The effect will vary, depending on how much your ratio of credit used versus available credit went up. To keep your credit scores steady, the Consumer Financial Protection Bureau, or CFPB, recommends that consumers keep their credit utilization rate below 30%.

Imagine that you have a $10,000 credit limit, of which you typically only use $1,500 (15% credit utilization rate). If your spending one month increases to $2,500, your utilization ratio will still be solid overall at 25%. But if your spending suddenly increased to $5,000 (50% credit utilization rate), your scores could start showing a decline.

4. Reduced credit limit

Why can a lower credit limit cause your credit scores to drop? Because your credit utilization rate will go up even if your spending stays exactly the same.

Consider this example. You typically spend $1,500 of your $7,000 credit limit for about a 20% credit utilization rate. That’s good. But then imagine that your credit limit is reduced to $5,000. In that case, your credit utilization rate would instantly jump to 30%.

If your credit scores take a hit after a credit limit reduction, take a close look at your utilization rate. You may need to reduce your credit card spending to improve your scores.

Alternatively, you may be able to look at opening a balance transfer credit card. This might be helpful on two fronts: It may help increase your overall credit limit, which in turn helps to lower your credit utilization rate. Additionally, if you qualify for a 0% introductory rate, you may be able to pay off your balance faster.

5. You closed a credit card

There are multiple reasons why closing a credit card can cause your credit scores to drop. First, when you eliminate a credit card, it reduces your available credit. So, if you don’t reduce your spending in kind, your credit utilization ratio will go up.

The second reason closing a credit card could hurt your credit scores would be if it hurts the average length of your credit history. The older an account, the more it could affect your average account age when you close it. Before you close your oldest credit accounts, consider whether it’s absolutely necessary.

6. You paid off a loan

Wait — paying something off can cause your credit scores to drop? While it may seem illogical, the answer is yes.

One reason that paying off a loan can have a negative effect on your credit scores is that it could change your credit mix. In general, having a healthy mix of revolving credit (like credit cards) and installment loans (like mortgages and auto loans) is good for your credit scores.

But this doesn’t mean that you should avoid paying off your loans only for the sake of your credit scores. You can still build strong scores without having one of each type of credit.

7. You’ve recently opened, or applied for, multiple lines of credit

When you open several credit accounts in a short period of time, you represent more of a risk to lenders. For this reason, your credit scores may drop if you’ve had several hard credit inquiries placed on your credit reports recently.

It’s important to point out that checking or monitoring your credit with tools like Credit Karma doesn’t affect your scores because it only results in a soft credit inquiry.

If you’re rate shopping, FICO® recommends that you do so in a short period of time. For example, if you’re shopping for a mortgage or auto loan within a 30-day period, the credit bureaus will typically group the inquiries together.

But if you’re considering applying for a credit card, keep in mind that you’ll get a ding on your credit reports for each credit card you apply for, no matter how close those hard inquiries are over a matter of days. So be sure to only apply for credit cards that you truly need.

8. Mistake on your credit reports

So far we’ve assumed that your credit scores dropped because of accurate information on your credit reports. But what if that’s not the case?

Lenders can make mistakes too. That’s why it’s important to check your credit reports to keep an eye out for errors. The CFPB says that credit report inaccuracies are one of the most common issues it deals with each day.

If you find a mistake on your credit reports, you have the right to dispute it with the credit bureaus and with the reporting lender. Companies are required to investigate the dispute free of charge and promptly correct errors that are confirmed.

9. You were the victim of identity theft

Finally, let’s address what might be the most frightening reason for a drop in credit scores: Someone could have stolen your identity and applied for (and opened) credit accounts in your name.

If you discover that an impostor is using your identity, don’t panic. There are actions you can take to help reverse the damage it may have caused to your credit scores.

But how do you spot identity theft in the first place? One step to consider is credit monitoring. Keeping a close eye on your credit scores and credit reports may help you catch suspicious activity faster than if you’re not regularly monitoring your accounts. You’re entitled to one free credit report periodically from each of the three major consumer credit bureaus at annualcreditreport.com.

If you’ve been a victim of identity theft, you’ll likely want to make a recovery plan. Placing a fraud alert on your credit file could be a good place to begin. You only need to place the alert with one of the national credit bureaus. The other two bureaus will be automatically notified.

After you’ve added your fraud alert to your credit profile, you may want to fill out an identity theft report with the FTC. Then you can begin the process of disputing inquiries on your report if necessary.

If you find that a fraud alert isn’t doing enough to slow down the identity thieves, you may want to consider freezing your credit. A credit freeze restricts access to your credit file, making it much more difficult for fraudsters to open accounts in your name.

Does Paying Off All Debt Increase Credit Score?

To better understand how your credit score can change after paying off debt, you should know the elements that make up your credit score.

There are two primary credit-scoring sources: FICO and VantageScore. Each has a different model — and lenders have their own algorithms, too.

Several factors impact a FICO Score:

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- New credit: 10%

- Credit mix: 10%

Next, let’s break down VantageScore and the role it says each factor plays:

- Amounts owed: Extremely influential

- Credit mix: Highly influential

- Payment history: Moderately influential

- Length of credit history: Less influential

- New credit: Less influential

Let’s take a look at a few ways these factors can affect your credit score.

Your credit utilization — or amounts owed — will see a positive bump as you pay off debts. Generally, it is a good idea to keep your credit utilization ratio below 30%. Paying off a credit card or line of credit can significantly improve your credit utilization and, in turn, significantly raise your credit score.

Read Also: Avoid Credit Damage Caused by Joint Debt After Divorce

On the other side, the length of your credit history decreases if you pay off an account and close it. This could hurt your score if it drops your average lower.

Finally

Paying off debt is rarely the wrong decision, especially high-interest consumer debt. This holds true even if it causes your credit score to temporarily go down. Your financial health is more important than your credit score, especially because there’s no way to fully predict the results of each action you take. Ultimately, if you continue to make timely payments on your outstanding debts and keep your spending in check, you should see your credit score start to rise again with time.