How to Build Good Credit

The importance of your credit score can never be overemphasized because it impacts a lot of things like your getting a job, loan, credit cards, basic utilities and services, or even rent an apartment or lease a car. When you have a good credit score, your profile is always attractive to both lenders and other businesses. This in turn will give you access to a lot of financial opportunities like higher credit limits and lower interest rates.

Your credit score is bound to change from time to time, this can be impacted by the different financial decisions that you make. If you make better financial decisions, you will watch your credit score improve and huge financial benefits will be yours.

What if you have made some financial mistakes and your credit score is not in a good shape at the moment? The information in this article will help you gradually restore your credit to the right shape.

- What is The Benefit of a Good Credit?

- What is The Fastest Way to Build Good Credit?

- How Long Does it Take to Get 700 Credit Score?

- What Are 5 Things You Can do to Establish Good Credit?

- How To Maintain a Good Credit Score

What is The Benefit of a Good Credit?

Establishing a good credit score will help you save money and make your financial life much easier. If you’re looking for reasons to maintain your good credit, here are some great benefits to having a good credit score.

Low-Interest Rates on Credit Cards and Loans

The interest rate is one of the costs you pay for borrowing money and the interest rate you get is often directly tied to your credit score. If you have a good credit score, you’ll almost always qualify for the best interest rates, and you’ll pay lower finance charges on credit card balances and loans. The less you pay in interest, the sooner you’ll pay off the debt, and the more money you’ll have for other expenses.

Read Also: How Does a Self Credit Card Work?

Better Chance for Credit Card and Loan Approval

Borrowers with a poor credit history typically avoid applying for a new credit card or loan, because they’ve been turned down previously. Having an excellent credit score doesn’t guarantee approval, because lenders still consider other factors such as your income and debt. However, a good credit score increases your chances of being approved for new credit. In other words, you can apply for a loan or credit card with confidence.

More Negotiating Power

A good credit score gives you leverage to negotiate a lower interest rate on a credit card or a new loan. If you need more bargaining power, you can take advantage of other attractive offers that you’ve received from other companies based on your credit score. However, if you have a low credit score, creditors are unlikely to budge on loan terms, and you won’t have other credit offers or options.

Get Approved for Higher Limits

Your borrowing capacity is based on your income and your credit score. One of the benefits of having a good credit score is that banks are willing to let you borrow more money because you’ve demonstrated that you pay back what you borrow on time. You may still get approved for some loans with a bad credit score, but the amount will be more limited.

Easier Approval for Rental Houses and Apartments

More landlords are using credit scores as part of their tenant screening process. A bad credit score, especially if it’s caused by a previous eviction or outstanding rental balance, can severely damage your chances of getting into an apartment. A good credit score saves you the time and hassle of finding a landlord who will approve renters with damaged credit.

Better Car Insurance Rates

Add auto insurers to the list of companies that will use a bad credit score against you. Insurance companies use information from your credit report and insurance history to develop your insurance risk score, so they often penalize people who have low credit scores with higher insurance premiums. With a good credit score, you’ll typically pay less for insurance than similar applicants with lower credit scores.

Get a Cell Phone on Contract With No Security Deposit

Another drawback of having a bad credit score is that cell phone service providers may not give you a contract. Instead, you’ll have to choose one of those pay-as-you-go plans that have more expensive phones. At a minimum, you might have to pay extra on your contract until you’ve established yourself with the provider. People with good credit avoid paying a security deposit and may receive a discounted purchase price on the latest phones by signing a contract.

Avoid Security Deposits on Utilities

Security deposits are sometimes $100 to $200 and a huge inconvenience when you’re relocating. You may not be planning to move soon, but a natural disaster or an unforeseen circumstance could change your plans. A good credit score means you won’t have to pay a security deposit when you establish utility service in your name or transfer service to another location.

Bragging Rights

Because of all the benefits, a good credit score is something to be proud of, especially if you’ve had to work hard to take your credit score from bad to good. If you’ve never had to experience a bad credit score, keep doing what it takes to maintain your good score. It only takes a few missed payments to start getting off track.

What is The Fastest Way to Build Good Credit?

When trying to build your credit, it is not going to happen overnight. However, there are ways to improve your credit fast. The reason why the credit is low may determine how fast the it will increase. So here are some actions you can take to build your credit the fastest.

1. Pay down your revolving credit balances

If you have the funds to pay more than your minimum payment each month, you should do so. Chipping away at your revolving debt can have a major impact on your credit score because it helps to keep your credit utilization rate low.

“How quickly [your score can go up] depends on how quickly the individual creditors report the paid balance on the consumer’s credit report.” Triggs says. “Some creditors report within days of the payment, some report at a specific time each month.” Credit card companies typically report your statement balance to the credit bureaus monthly, but this could vary depending on your issuer. You can call or chat online with your card issuer to find out when they report balances to the bureaus.

The sooner you can pay off your balance each month the better. You can also make multiple payments toward your balance throughout the month so it is easier to track your spending, and it keeps your balance low. And although it helps to even pay off a portion of your debt, paying off the entire balance will have the biggest and fastest impact on your credit score.

2. Increase your credit limit

You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. The higher your overall available credit limit, the lower your credit utilization rate (as long as you’re not maxing out your card each month). Before asking for a credit limit increase, make sure you won’t be tempted to spend more than you can afford to pay off.

If you are considering opening a new credit card, do your research beforehand. How often you apply for and open new accounts gets factored into your credit score. Each application requires the card issuer or lender to pull your credit report, which results in a hard inquiry on your report and dings your credit score a few points.

“Usually the negative impact of those factors is much less than the benefit to your score of reducing your credit utilization ratio,” Triggs says. Just make sure you don’t apply to too many credit cards over a short amount of time and send a red flag to issuers.

It’s more important now than ever to do your research before applying for new credit because issuers may have stricter terms and requirements in wake of the economic fallout from coronavirus. Check to see what your credit score is beforehand.

Most of the best rewards credit cards require good or excellent credit to qualify, but there are some cards catered to those with less than stellar credit. The Petal® 2 “Cash Back, No Fees” Visa® Credit Card has no fees whatsoever*, offers cash back and allows applicants with no credit history to apply. If you have a credit file, it does factor into the application process. The Capital One QuicksilverOne Cash Rewards Credit Card accepts fair or average credit and offers 1.5% cash back on all purchases.

3. Check your credit report for errors

One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you. Your score may increase if you are able to dispute them and have them removed.

About 25% of Americans have an error on their credit reports, so it’s important to take the time to review. Some common errors to look out for include fraudulent or duplicated accounts, as well as misreported payments.

“Most of the clients we meet with have not reviewed their report within the past year, and are often surprised by what we find to discuss with them,” says Thomas Nitzsche, a financial educator at MMI.

4. Ask to have negative entries that are paid off removed from your credit report

You may have a series of late payments on your credit report, or perhaps an old collection account that’s since been paid off still shows up. If this is the case, ask to have them removed. (And if you do have a collection account that’s unpaid, make this a priority. Unpaid collection accounts can negatively impact your score.)

This step may take more time and effort on your end, but it could be worth it. Triggs suggests speaking to the collections agency, debt buyer or original creditor (depending on who now services your account) to remove a paid-off account from your credit report.

“You’d most likely have better results using this method with collection agencies or debt buyers versus the original creditor,” he says.

Try to convince them to not only show the account as paid, but to remove the account altogether, which could have a much bigger impact on your credit score. “Having even a paid collection account or paid charge-off on your credit report could deter creditors in issuing you future credit at all,” Triggs says.

How Long Does it Take to Get 700 Credit Score?

Building your credit score is not going to be an easy task, infact it will take patience and a lot of discipline to achieve it.

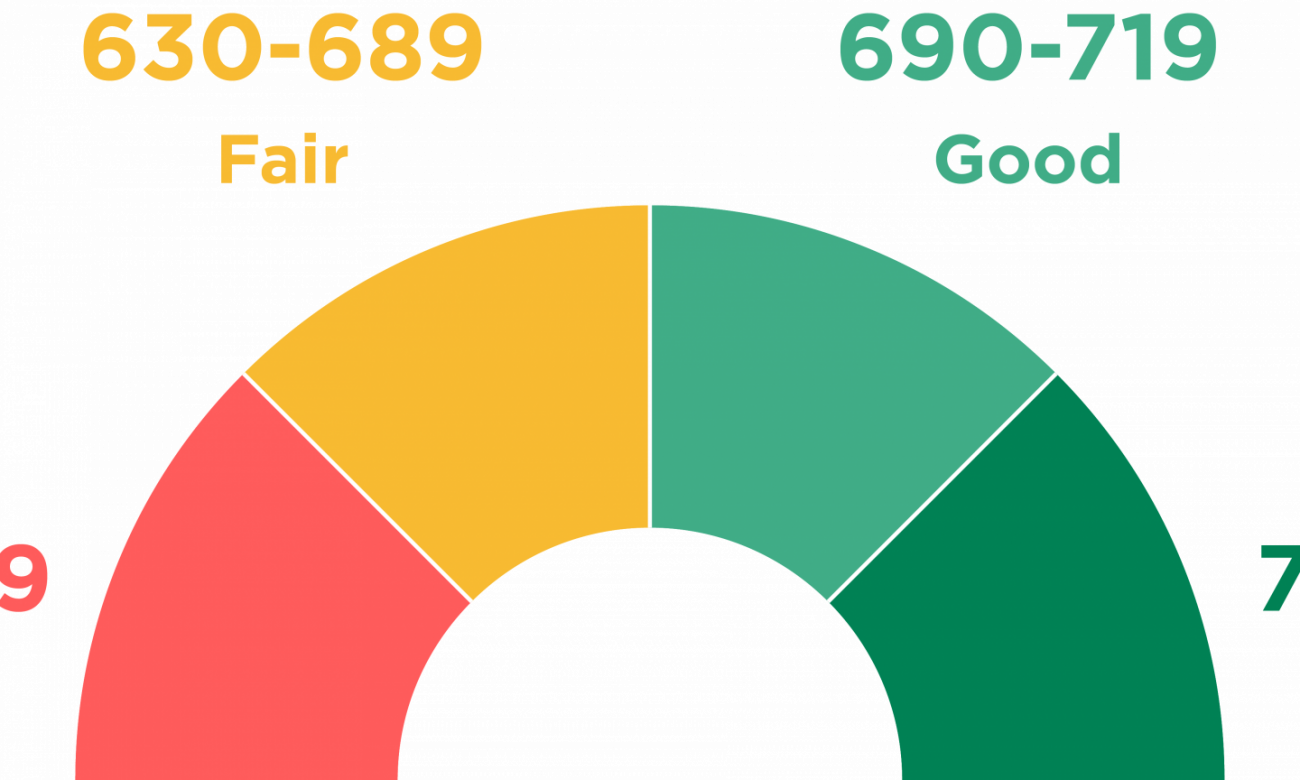

To build a credit score from scratch, you first need to use credit, such as by opening and using a credit card or paying back a loan. It will take about six months of credit activity to establish enough history for a FICO credit score, which is used in 90% of lending decisions. FICO credit scores range from 300 to 850, and a score of over 700 is considered a good credit score. Scores over 800 are considered excellent.

Don’t expect a spectacular number right off the bat. While you can build up enough credit history in less than a year to generate a score, it takes years of smart credit use to get a good or excellent credit score.

When you are just starting to build a credit score, time doesn’t work in your favor. Lenders want to see good behavior over time, which is much of what FICO scores take into account:

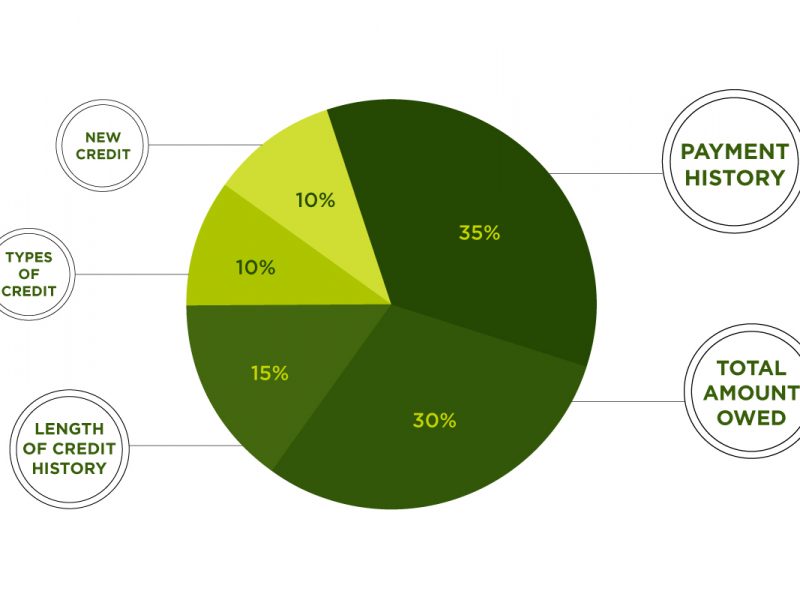

- Payment history (35% of score): Have you made on-time payments consistently?

- Amounts owed (30% of score): How much debt do you have compared to how much available credit you have?

- Length of credit history (15% of score): On average, how long have your accounts been open?

- New credit (10% of score): Have you opened several new credit accounts in a short amount of time?

- Credit mix (10% of score): Do you have experience managing different types of credit and loan?

Proof that you make payments on time and don’t carry large balances on credit cards makes you a less risky, more trustworthy credit user in the eyes of lenders. Those responsible behaviors carry more weight when demonstrated over time, too, which is why building a good credit score from scratch doesn’t happen overnight.

What Are 5 Things You Can do to Establish Good Credit?

Get a secured credit card

If you’re building your credit score from scratch, you’ll likely need to start with a secured credit card. A secured card is backed by a cash deposit you make upfront; the deposit amount is usually the same as your credit limit. The minimum and maximum amount you can deposit varies by card. Many cards require a minimum deposit of $200. Some companies such as Avant, Deserve, Petal and Jasper now offer alternative credit cards that don’t need a security deposit.

You’ll use the card like any other credit card: Buy things, make a payment on or before the due date, incur interest if you don’t pay your balance in full. You’ll receive your deposit back when you close the account.

Secured credit cards aren’t meant to be used forever. The purpose of a secured card is to build your credit enough to qualify for an unsecured card — a card without a deposit and with better benefits. Choose a secured card with a low annual fee and make sure it reports payment data to all three credit bureaus, Equifax, Experian and TransUnion. Your credit score is built using information collected in your credit reports; cards that report to all three bureaus allow you to build a more comprehensive credit history.

Get a credit-builder product or a secured loan

A credit-builder loan is exactly what it sounds like — its sole purpose is to help people build credit.

Typically, the money you borrow is held by the lender in an account and not released to you until the loan is repaid. It’s a forced savings program of sorts, and your payments are reported to credit bureaus. These loans are most often offered by credit unions or community banks; Self offers them online, as does SeedFi.

Kikoff offers a $500 line of credit that is designed strictly to be a credit-building tool.

Another option: If you have money on deposit in a bank or credit union, ask them about a secured loan for credit-building. With these, the collateral is money in your account or certificate of deposit. The interest rate is typically a bit higher than the interest you’re earning on the account, but it may be significantly lower than your other options.

Use a co-signer

It’s also possible to get a loan or an unsecured credit card using a co-signer. But be sure that you and the co-signer understand that the co-signer is on the hook for the full amount owed if you don’t pay.

Become an authorized user

A family member or significant other may be willing to add you as an authorized user on his or her card. Doing so adds that card’s payment history to your credit files, so you’ll want a primary user who has a long history of paying on time. In addition, being added as an authorized user can reduce the amount of time it takes to generate a FICO score. It can be especially useful for a young person who is just beginning to build credit.

You don’t have to use — or even possess — the credit card at all in order to benefit from being an authorized user.

Ask the primary cardholder to find out whether the card issuer reports authorized user activity to the credit bureaus. That activity generally is reported, but you’ll want to make sure — otherwise, your credit-building efforts may be wasted.

You should come to an agreement on whether and how you’ll use the card before you’re added as an authorized user, and be prepared to pay your share if that’s the deal you strike.

Get credit for the bills you pay

Rent-reporting services such as Rental Kharma and LevelCredit take a bill you are already paying and put it on your credit report, helping to build a positive history of on-time payments. Not every credit score takes these payments into account, but some do, and that may be enough to get a loan or credit card that firmly establishes your credit history for all lenders.

Experian Boost offers a way to have your cell phone and utility bills reflected in your credit report with that credit bureau. Note that the effect is limited only to your credit report with Experian — and any credit scores calculated on it.

How To Maintain a Good Credit Score

All it takes to raise your credit score are positive changes to your credit report information. It’s actually easier to damage your credit than it is to build it, so here’s what you should do to keep your credit on the up and up once you get started.

Only Charge What You Can Afford

Credit cards are a tool, not an excuse for a shopping spree. If you open a card to start building a credit score, use it for small purchases that fit your budget and pay the card off in full each month. Regular use and full payment are important, because your credit utilization ratio—the proportion of debt compared to available credit—is the second biggest factor impacting your credit score.

If You Carry a Balance, Pay More Than the Minimum Due

The goal is to keep your credit utilization ratio as low as possible, so the more you can pay each month, the better. You will chip away at your debt faster, helping to decrease your credit utilization rate and raise your score, and you will save money on interest.

Pay Your Bills on Time

Since payment history has the most impact on your credit score, don’t let late payments derail your progress.

Don’t Apply for Lots of New Credit Cards

When you apply for a new credit card or loan, the issuing bank will check your credit, which is considered a hard inquiry. Hard inquiries will cause your credit score to dip temporarily. It’ll bounce back as time passes and more positive behavior is reported. However, if you are already starting from scratch, even a slight dip of five to 10 points can be significant.

Read Also: The Real Truth About Credit Card Security Code

Plus, credit bureaus keep tabs on how many times you apply for new lines of credit. Too many hard inquiries on your credit report can be a sign that you are desperately seeking credit and pose a risk to lenders.

Don’t Close Any Card Accounts

When you are new to credit and building a score from nothing, time is your friend. Even if a year from now, you have a card you no longer want or use, keep the account open unless it charges an annual fee. The length of your credit history directly affects your FICO score, so the longer your accounts are open, the better your credit score.

Monitor Your Credit Report

You’re entitled to a free copy of your credit report every year from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Visit AnnualCreditReport.com to access a free report and familiarize yourself with it. Check for inaccuracies and signs of fraud, and if you find something amiss, report it immediately.