How Soon Will my Credit Score Improve After Bankruptcy?

It is not always an easy decision to file for bankruptcy, and the complex legal process can not only be challenging but damaging to your credit score. However, the effect of bankruptcy on your credit report isn’t forever and will last for seven or 10 years, depending on the type.

In fact, the impact of bankruptcy decreases over time and there are a number of ways to improve your score in the meantime. Often time, you will be concerned about the time period it will take for your credit score to go back to normal and even improve further.

This article will give some tips on how to improve your credit score after bankruptcy and how soon it might take. Let’s jump in.

- How Soon Will my Credit Score Improve After Bankruptcy?

- How Much Does Credit Score Improve After Bankruptcy?

- Will my Credit Score go up After Bankruptcy is Removed?

- 7 Ways To Rebuild Your Credit Score After Bankruptcy

- How Long Does It Take to Rebuild Your Credit After Chapter 7 Bankruptcy?

- How Long Does It Take to Rebuild Your Credit After Chapter 13 Bankruptcy?

- How Long After Bankruptcy Can You Get a 700 Credit Score?

- How to Rebuilding Creditworthiness After Bankruptcy

How Soon Will my Credit Score Improve After Bankruptcy?

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can’t remove bankruptcy from your credit report unless it is there in error.

Read Also: How Does Debt Validation Work?

Over this 12-18 month timeframe, your FICO credit report can go from bad credit (poor credit is traditionally less than 579) back to the fair range (580-669) if you work to rebuild your credit. Achieving a good (670-739), very good (740-799), or excellent (800-850) credit score will take much longer.

The higher your FICO score is before a bankruptcy filing, the more it will affect your credit rating:

| Score | Average Drop in Credit Score |

| Excellent (850-800) | 200 points |

| Very Good (740-799) | 200 points |

| Good (670-739) | 200 points |

| Fair (580-669) | 130-150 points |

| Poor (300-579) Note: Scores do not go lower than 300 | 130-150 points |

You will likely drop to a poor credit score no matter what score you started with. Your credit history already shows you filed for bankruptcy, but credit bureaus want to ensure you take steps to improve your bad credit before you take on more debt and new credit.

The sliding scale system will generally knock your credit points however much it takes to show you have poor credit. Your score may barely change if you already have bad credit (less than 579). It is not common to see credit scores lower than 500 even after a bankruptcy filing.

How Much Does Credit Score Improve After Bankruptcy?

Bankruptcy is a tradeoff. It wipes away or reduces debt that you can’t afford to pay, but it tells the world that you’re a credit risk. That gets reflected on to your credit score, which can drop dramatically and make it tough to borrow and spend. Getting a credit card, a personal bank loan or a mortgage can be very difficult in the near term, and it can take years before the fallout from the bankruptcy to clear.

That being said, many people considering filing for bankruptcy already have low scores. In those cases, bankruptcy can actually increase your credit score. This happens because bankruptcy can actually clear negative items from your credit report – leaving only the bankruptcy itself as a negative remark.

Before you file bankruptcy, you should understand the consequences. The bankruptcy will be reflected on your credit score for as long as 7-to-10 years depending on the type of bankruptcy you enter. Until the nation’s three large credit-rating bureaus remove the bankruptcy from your credit report, any potential lender will know you filed a bankruptcy. But you can take immediate steps to begin restoring your creditworthiness.

Will my Credit Score go up After Bankruptcy is Removed?

How long your bankruptcy stays on your credit report depends on the type of bankruptcy you file. The two most common types of consumer bankruptcy are Chapter 7 and Chapter 13. In a Chapter 7 bankruptcy, you do not repay any of the debt owed. This type of bankruptcy listing remains on the credit report for 10 years from the date it is filed. Under Chapter 13 bankruptcy, you are responsible for paying back a portion of the debts that you owe through a debt repayment plan. A Chapter 13 bankruptcy is removed from your report seven years from the date it is filed.

Having a bankruptcy in your credit history will seriously affect your ability to obtain credit for as long as it remains on your report. If you do qualify for credit while the bankruptcy is part of your credit history, you will likely have to pay higher interest and fees than you would otherwise. It can also affect your ability to qualify for things like an apartment, utilities and even employment. Even insurance rates may be affected.

7 Ways To Rebuild Your Credit Score After Bankruptcy

Though you can’t do anything about the amount of time bankruptcy remains on your credit report, you can take steps that will speed the rate at which your score recovers.

First, don’t fall for a pitch from a credit repair company that offers to restore your credit rating for a fee. It can’t be done and anybody who says it can is a scam artist. The only way to begin rebuilding credit is to become a paragon of financial responsibility.

1. Check Your Credit Report

If you’re trying to repair your credit after bankruptcy, start by familiarizing yourself with your credit report. All consumers can access a free copy of their credit report through AnnualCreditReport.com. Free reports are typically only available once a year—but in the wake of the Covid-19 pandemic, consumers can access free weekly reports through April 20, 2022.

Understanding what makes up your credit score can make it easier to make targeted improvements and provide insight into why your score is or is not increasing. You’ll also be able to spot any errors that are bringing your score down—such as incorrect account information or inaccurate public records.

Reviewing your credit report can also help you confirm that your bankruptcy is removed from your report as soon as possible—after seven years for a Chapter 13 bankruptcy and after 10 years for a Chapter 7.

2. Monitor Your Credit Score

Bankruptcy will likely cause an initial drop in your score of 100 to 200 points or more, though this varies and the effects improve over time. Checking your credit score from month to month is a critical step in improving your score after bankruptcy. To do so, create an account with a free online service; several credit card companies also offer customers free score updates.

Once your accounts are discharged during the bankruptcy process, check your score to confirm that these changes were accurately reported.

To avoid further decreases, monitor your credit score for any red flags that may signal identity theft or other issues. This may include fraudulent loan applications made in your name, inaccurate account statuses or civil suits or judgments you weren’t involved in. While score increases may come slowly, checking your credit score regularly is also an effective way to stay motivated as you take steps to improve your credit habits.

3. Practice Responsible Credit Habits

Your credit score will improve as your bankruptcy fades into the past, but healthy financial habits are necessary to truly rebuild your credit after bankruptcy. Consider these recommendations to get started:

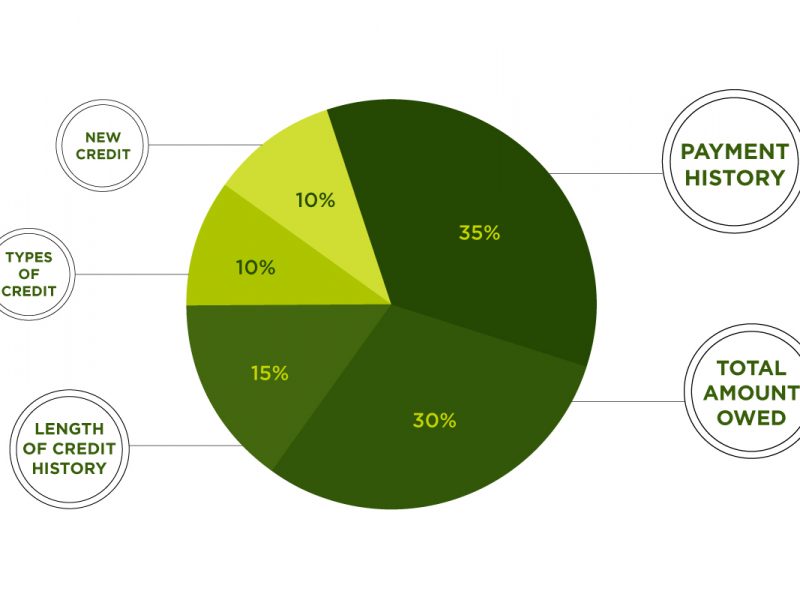

- Make consistent, on-time payments. Payment history accounts for 35% of your FICO Score calculation, so it’s imperative that you make on-time payments when rebuilding credit after bankruptcy. In addition to making consistent, on-time payments, stay on top of other bills, like utilities, because these can also improve your score via services like Experian Boost.

- Reduce your credit card use. Depending on how you arrived in bankruptcy, one of the biggest risks can be falling into the same habits that led you into financial trouble before. Reducing your credit card use—or avoiding them altogether—can temper the temptation to spend and reduce the likelihood of this happening.

- Keep your credit balances low. The balance you owe makes up 30% of your FICO score calculation. For this reason, keeping your credit balances low is integral to rebuilding credit after bankruptcy. To do so, try to reduce card usage and aim to pay off balances each month.

- Build an emergency savings fund. If possible, aim to earmark money to build an emergency savings stash so you’re covered for unexpected expenses like car repairs and medical bills. This can help you avoid incurring future debt that can slow or even reverse efforts to rebuild your credit.

- Take your time. Be patient. The amount of time it takes to rebuild your credit after bankruptcy varies by the borrower, but it can take from two months to two years for your score to improve. Because of this, it’s important to build responsible credit habits and stick to them—even after your score has increased.

4. Get a Secured Credit Card

Reducing your dependence on credit cards can be an important step toward rebuilding credit after bankruptcy. However, the strategic use of secured credit cards can also help you begin to repair your trustworthiness in the eyes of lenders.

Taking out a secured credit card requires making a refundable security deposit and then borrowing against it. While these cards tend to come with high-interest rates, if they report to all three credit bureaus, they’re a great option to show responsible credit behavior until you’re better qualified for a traditional card with more competitive terms.

Some secured cards even allow you to “graduate” to an unsecured card after consistent on-time payments. This is a benefit since you won’t have to apply for a new, unsecured card when your credit improves,

Keep in mind, however, that applying for a secured card doesn’t guarantee acceptance, so take time to research the provider’s requirements before applying. If possible, choose a provider that offers prequalification so you can see whether you’re likely to qualify before agreeing to a hard credit check that can further damage your score.

5. Consider a Credit-builder Loan

Credit builder loans are another way to build your credit without having to qualify for a traditional loan. With a credit-builder loan, the lender holds a certain amount of money in a secured savings account or certificate of deposit in the borrower’s name. The borrower then makes monthly payments—including interest—until the loan is repaid.

Depending on your bank, you may also have the option of a secured loan, where you borrow against money already in your savings account. As with traditional loans, the financial institution reports credit-builder loan payment activity to the major credit bureaus, which can improve your score over time.

6. Utilize a Co-signer

If you struggle to qualify for a loan or rental agreement after filing for bankruptcy, a co-signer can help you qualify. A co-signer is someone who agrees to pay back a loan if you, the primary borrower, fail to do so. The co-signer doesn’t have any right to the loan funds or financed property, but they will be responsible for the outstanding loan balance if you fail to make on-time payments. Likewise, their credit score will also be damaged if you miss payments or default.

For these reasons, you should carefully consider who you ask to serve as your co-signer and be understanding if they decline to do so. To find a co-signer, ask a friend or family member who is financially stable and then provide an easy out—just because someone is able to serve as a co-signer doesn’t mean she is willing to do so.

7. Ask to Become an Authorized User

Getting someone to co-sign on a loan may be a tall order, but building your credit as an authorized user on someone else’s credit card is often more feasible. Being an authorized user involves having a card in your name that’s attached to another borrower’s account, not your own. You’ll be able to use the card for purchases without having to qualify for the account on your own merits—but you won’t be able to modify the account.

Credit card payments will show up on your credit report, so if these payments are made on time and the credit utilization rate stays low, your score will improve over time. Just make sure the credit card company reports authorized user payments to the three main credit bureaus so you have the greatest chance of increasing your score. While this isn’t as impactful as other methods of increasing a credit score, it can still be helpful as part of a larger strategy.

How Long Does It Take to Rebuild Your Credit After Chapter 7 Bankruptcy?

A Chapter 7 bankruptcy stays on the borrower’s credit report for 10 years. This means that after 10 years, all records of the bankruptcy must be removed from your credit report. That said, the impact the bankruptcy has on a credit score decreases as time passes—due in part to the immediate reduction in the consumer’s debt-to-income (DTI) ratio, which is how much you owe in relation to the amount of available credit you have. Because of this, you may start to see improvements in as little as one to two years after discharge.

How Long Does It Take to Rebuild Your Credit After Chapter 13 Bankruptcy?

Unlike a Chapter 7 bankruptcy, a Chapter 13 bankruptcy stays on a consumer’s credit report for just seven years. In general, though, it takes anywhere from 12 to 18 months to start improving your credit score after your Chapter 13 bankruptcy is discharged. Many borrowers can refinance their restructured debt after 18 months.

How Long After Bankruptcy Can You Get a 700 Credit Score?

One of the biggest benefits of bankruptcy that people tend to frequently overlook (or are unaware of) is the positive impact that it can have on your credit score. While this may seem counterintuitive, the fact is that bankruptcy can (and in many cases does) have a very positive impact on your credit score. In some cases, you may experience a dramatic increase in your credit score.

How long does it take to have a 700 credit score after you file? After reaching 600, one to two years after bankruptcy, if you continue to practice good credit habits, your credit score will continue to gradually improve. By continuing to pay all of your bills on time, and properly establishing new credit, you can often attain a 700 credit score after bankruptcy within about 4-5 years after your case is filed and you receive a discharge.

Can a lawyer guarantee you a particular score after filing bankruptcy? No. Nobody can “guarantee” you a particular score. FICO is constantly changing its formulas and standards. No one, not even a FICO lawyer, has a crystal ball or knows how the FICO algorithm may change or evolve in the future.

The most you can do is base your decision on concrete facts at your disposal. The reality is that most of our clients have a score in the low 600s, or even higher, within one to two years after they file bankruptcy and obtain a discharge. Some of our clients end up with a 700 score within 2-3 years after their case is filed and they receive a discharge.

So while nobody knows for sure what the future has in store, it’s a pretty good bet that you’ll have a similar experience to many of our clients and enjoy at least a 600 score soon after your case is filed and you receive a discharge. And if your score is currently in the 500s, then a bump up to 600 is, without question, a significant improvement from your current position.

Practicing Good Habits

One of the things that an experienced San Diego bankruptcy lawyer will be able to show you is how to practice good credit habits so that you can rebuild your credit and increase your FICO score as rapidly as possible. There are a few simple tips you can follow to help improve your position, such as paying your bills on time, reaffirming car loans by executing a reaffirmation agreement, opening new revolving accounts, and paying them on time. You should discuss these tips with your lawyer and proceed with guidance from your lawyer to give you the best results.

How to Rebuilding Creditworthiness After Bankruptcy

Here are some steps to help you rebuild:

- When you receive a legitimate bill for anything, pay it before the due date. If you have an account from before a bankruptcy filing (a home mortgage, for instance), make sure you never fall behind on a payment. If you filed Chapter 13, always make court-ordered payments to creditors on time.

- Open a secured credit card account. Credit card issuers will give you a secured card if you deposit cash that covers the credit limit. If you want a credit card with a $1,000 spending limit, you’ll post $1,000 to the card issuers as a security deposit. Though this might seem strange at first, it offers the convenience of paying with plastic and, if you make payments when they’re due, your credit score will improve.

- Monitor your credit score monthly using CreditKarma or Chase Credit Journey, two websites that provide scores. If you use credit responsibly and pay bills on time, your score gradually will rise. Eventually, you will be able to obtain an unsecured credit card, which you should do.

- Don’t go overboard. One secured credit card is all you need early in post-bankruptcy. Simply using the secured card and then paying the monthly statement in full will begin rebuilding your credit. If you had trouble managing money in the past, the disciplined use of a single card will not just rebuild your credit score, it might even help you build new and better spending habits.

- When your credit score begins improving, plan a spending strategy. If you qualify for a no-fee credit card, choose it rather than one that charges an annual fee. Make a budget and stick to it so you never again accrue debts that you’re unable to pay down monthly. If an emergency forces you to run over budget and run balances on your credit cards, aggressively pay off the card debt as soon as the emergency passes. Try to build an emergency fund so you don’t need to run credit card balances in the first place.

- If you have student loans, keep paying them. Student loans generally can’t be discharged through bankruptcy but paying them on time signals the credit-rating bureaus that you are managing your debt well, and that will help revitalize your credit score.

- Consider a credit-builder loan if you need money and have the means to repay the loans. Community banks and credit unions most commonly offer these loans at affordable interest rates. If you borrow $500 or $1,000 and pay it off on schedule, it will become part of your credit report and will help improve your score.

Bottomline

Perhaps the most frustrating part of filing for bankruptcy is how long it takes to rebuild your credit after the fact. The amount of time a bankruptcy stays on your credit report varies depending on the type of bankruptcy. Beyond that, the credit repair process depends largely on whether a borrower takes intentional steps to actively improve his score.